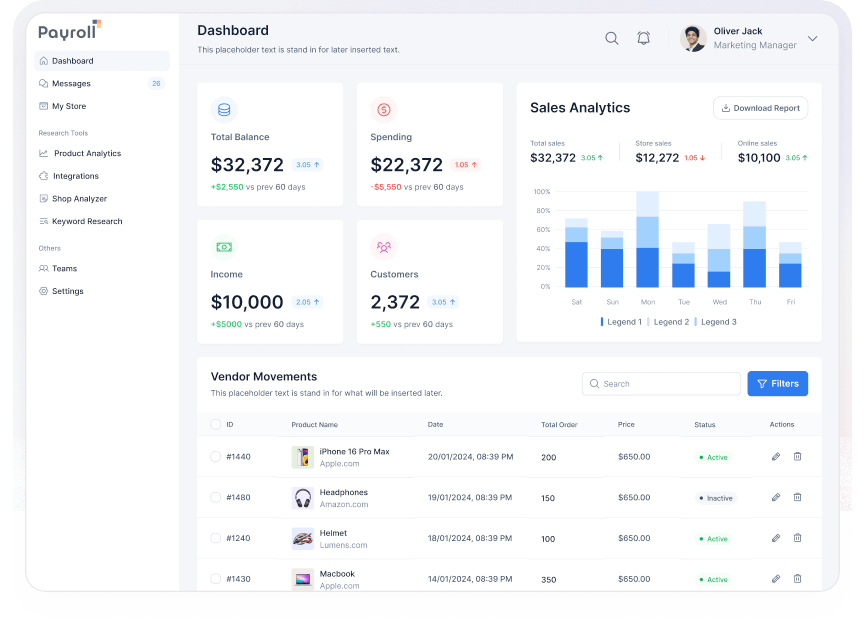

Comprehensive Cloud Payroll Management System

Effortlessly manage all payroll essentials, including salary calculations, pay slip generation, social security contributions, tax deductions, and compliance. Streamline operations and ensure accuracy with an integrated, user-friendly solution.

Adjustable Payroll

Flexible Payroll Period and Rules Settings

Tailor the payroll period to suit your organization's requirements. For example, you can set the payroll period from the 25th of the current month to the 24th of the following month. You can also define specific policies for lateness, overtime, absenteeism, and other factors. These rules can be applied company-wide, to individual branches, specific departments, or even to individual employees.

-

Customizable employee late logins and absence

-

Branch login

-

Fully Customizable

Customize salary structure

Customizable Salary Components and Structures

Easily define entitlements like Basic Salary, Allowances, Provident Fund, Medical Benefits, and more, along with deductions such as Income Tax, Social Security, Loan Repayments, and others. Customize the salary structure for each employee individually or streamline the process by importing data from Excel for multiple employees simultaneously.

-

Customize the salary structure

-

Streamline the process

-

Customizable Salary Components

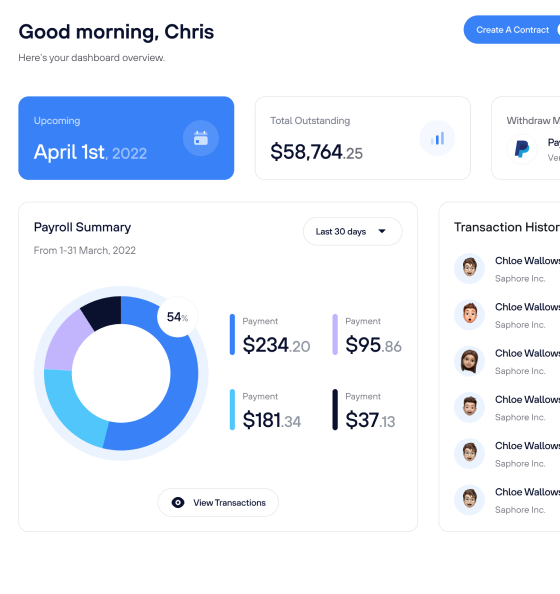

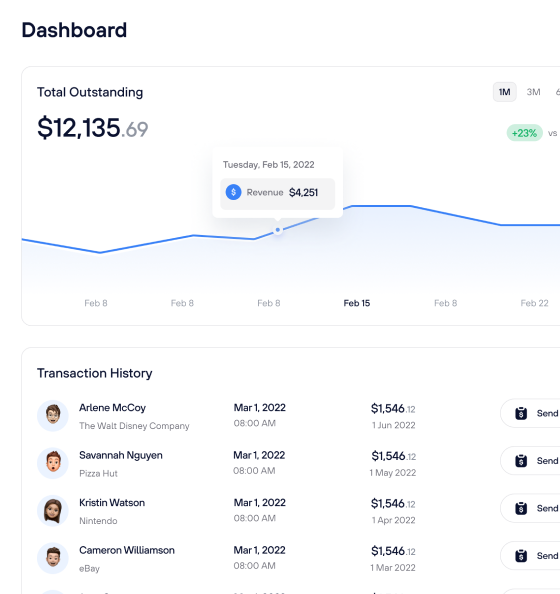

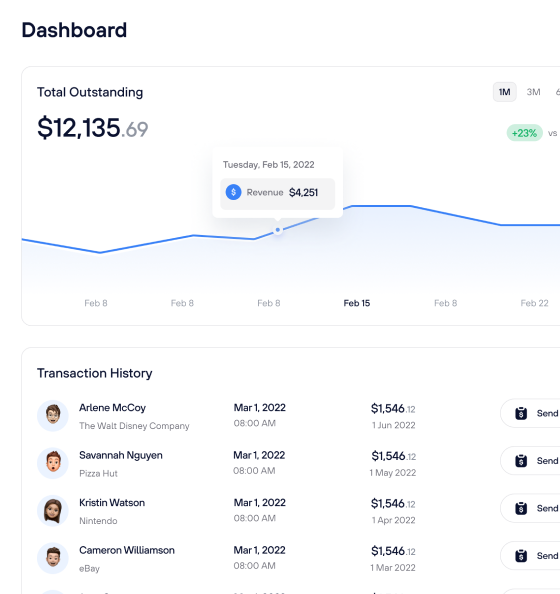

Generate and approve payroll

Payroll Processing, Pay Slip Management, and Bank Instructions

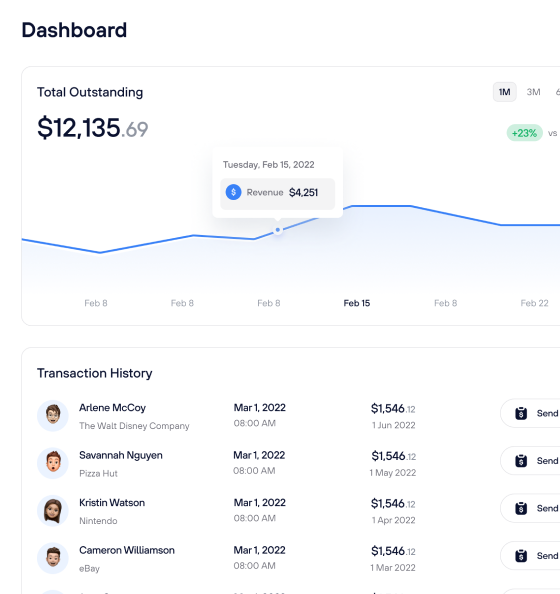

Generate and approve payroll for any selected month, enabling employees to view detailed breakdowns of their earnings, deductions, taxes, and other income components. Streamline the salary deposit process by using the pre-designed Bank Advice Template to send instructions directly to the bank for transferring salaries into employees’ accounts.

-

Detailed breakdowns of their earnings

-

East salary deposit process

-

Send Bank Advice to deposit salary

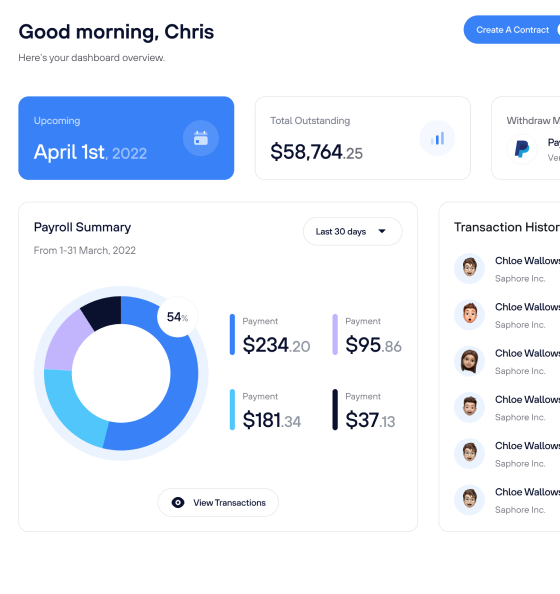

Keep track of salary advances

Employee Advances and Amortization Management

Track salary advances given to employees by recording the amount and setting up automatic monthly deductions from their salary to repay the advance. This ensures that repayments are made consistently and on time. Additionally, monitor any loans provided to employees, recording the details of each loan and creating repayment schedules that specify how much needs to be repaid each month. This helps in managing employee debts effectively and ensures proper financial planning.

-

Easy monitor any loans provided to employees

-

Creating repayment schedules

-

Managing employee debts effectively

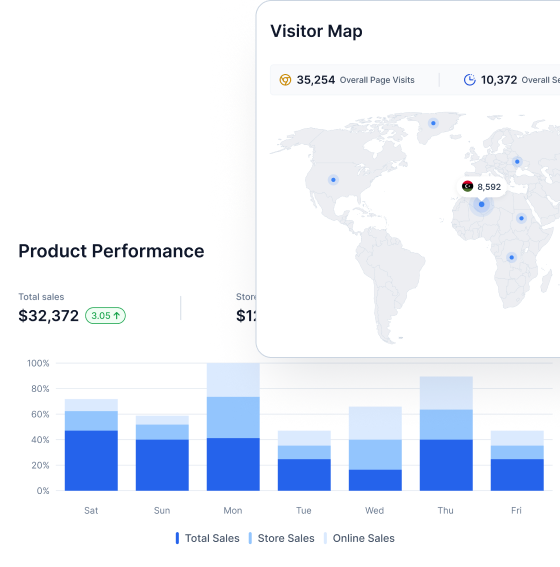

Streamlining and Simplifying Staff Management Processes

Our Payroll Application Software is a comprehensive platform designed to help businesses enhance their employee management experience. It offers a seamless solution for handling various payroll functions, from calculating salaries to managing benefits and deductions. The system is built with scalability in mind, allowing businesses of all sizes to easily adapt as they grow. By streamlining processes and providing efficient tools for payroll, attendance, and other HR tasks. Payroll App empowers businesses to focus on growth while ensuring smooth and accurate employee management.

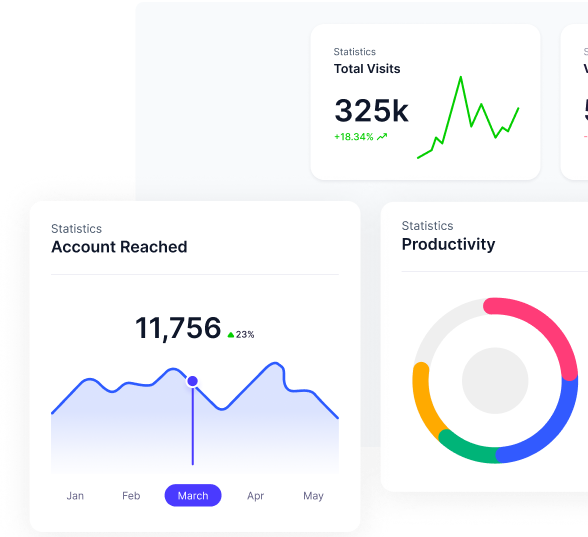

Track

Tracking is the foundational step in payroll management. It involves keeping a detailed record of various payroll elements such as employees' working hours, overtime, leaves, bonuses, deductions, and any adjustments made to the salary. A payroll system tracks attendance, sick leaves, paid time off, and other relevant factors that impact payroll calculations.

It also tracks any changes in salary, bonuses, or deductions over time. By maintaining accurate tracking, businesses ensure that they have up-to-date records for all employees, which is crucial for compliance, reporting, and accurate payroll processing.

Manage

Management of payroll is about overseeing and configuring the essential elements of the payroll system. This includes setting up salary structures, defining different types of deductions (taxes, insurance, retirement contributions, etc.), and managing employee-specific entitlements such as paid leaves, bonuses, or allowances.

Additionally, managing advances and loans involves setting up repayment schedules, ensuring that they are deducted correctly from employees’ monthly salaries. A robust payroll system allows easy customization and management of these components, enabling businesses to adjust rules, rates, and schedules as required.

Process

Payroll processing is the calculation phase where all payroll components are applied to each employee’s earnings. This involves calculating base salaries, adding bonuses, calculating taxes, and applying deductions for items like retirement funds, insurance, or advances. The system processes all these components and ensures that every calculation is accurate.

Payroll processing also includes adjusting for overtime, holiday pay, or commission-based earnings. Once all the figures are calculated, the payroll system prepares a summary for each employee, detailing their gross pay, deductions, and net pay.

Verify

Verification is a critical step in the payroll process to ensure that all payroll calculations are accurate before finalizing. This involves reviewing the data entered in the payroll system, checking the accuracy of salary calculations, confirming that tax deductions are applied correctly, and ensuring that any bonuses or adjustments have been factored in properly.

Verification also includes ensuring compliance with tax laws and employment regulations. A thorough verification step reduces the risk of errors and ensures that employees are paid accurately, avoiding potential legal or financial issues.

Pay

Once the payroll is verified, the next step is payment. This involves disbursing employees' wages through their preferred method, such as direct bank transfers, checks, or other payment methods. The payroll system generates pay slips for each employee, which include detailed information such as gross pay, deductions, taxes, bonuses, and the net pay they will receive.

The system ensures that payments are made on time and according to the agreed-upon payroll schedule (weekly, bi-weekly, or monthly). Providing clear pay slips helps employees understand their earnings and deductions, ensuring transparency and trust in the payroll system.

Frequently Asked Questions

HR Khata is a platform that simplifies payroll and employee management for businesses.

HR Khata is an employee management platform designed to simplify payroll, track employee attendance, and handle various HR tasks. It streamlines salary calculations, benefits management, and payroll processes, providing an exceptional experience and scalability for businesses of any size.

HR Khata Payroll and Employee Attendance Software tracks key payroll components, including employee working hours, overtime, leaves, bonuses, and deductions. It keeps detailed records of all payroll-related data to ensure accurate and up-to-date information for each employee.

HR Khata Payroll and Employee Attendance Software allows businesses to manage employee advances and set up loan repayment schedules. It tracks the amount of the advance and automatically deducts monthly repayments from employees' salaries, ensuring accuracy and timely deductions.

HR Khata Payroll and Employee Attendance Software includes a verification step in the payroll process where all calculations, such as taxes, bonuses, and deductions, are reviewed. This step ensures that all figures are accurate, compliant with tax laws, and free from errors before finalizing payments.

HR Khata Payroll and Employee Attendance Software supports various payment methods, including direct bank transfers, checks, and other available payment options. It ensures that employees are paid on time and provides detailed pay slips with information on gross pay, deductions, and net pay.

Get Started with HR Khata?

Switching to HR Khata Payroll and Employee Attendance Software allows businesses to simplify and streamline staff management processes. It offers an easy-to-use platform that automates payroll, tracks employee attendance, manages benefits, and ensures compliance with tax regulations.